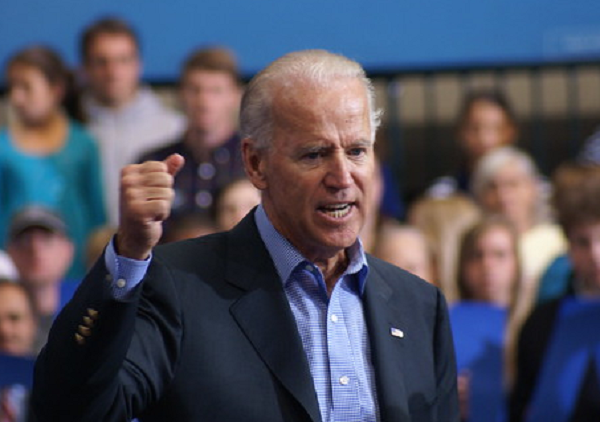

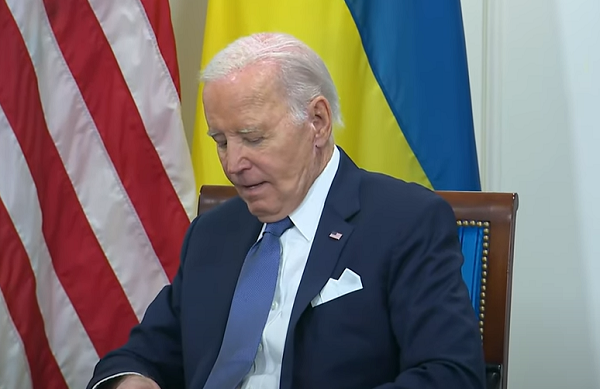

President Joe Biden is preparing to initiate another effort to decrease student loan debt for millions of Americans. Despite the noble justifications the administration may provide for the initiative, the truth remains that it is merely another endeavor by the Democrats to secure votes from Americans using their own funds. The Wall Street Journal’s exclusive report reveals that Biden will present the plan in a speech in Madison, Wisconsin, strongly suggesting that his primary objective is re-election rather than debt relief. Wisconsin is among the most hotly contested swing states, having been won by former President Donald Trump in 2016 and Biden in 2020, both times by margins of fewer than 25,000 votes.

The victories by Republican candidates and causes in Tuesday’s elections in the state must have undoubtedly raised concerns for Team Biden. The Journal highlighted previous polls indicating that Biden is not only behind in six of the seven most crucial battlegrounds for the 2024 election but also leading Trump by only 10 points among voters under 30, compared to the 25-point lead Biden had over Trump in this age group in 2020. Therefore, what better way to win back some of those voters than by enticing them with their own money?

While the specifics of Biden’s new proposal are not yet known, the fact that he is making a second attempt to forgive billions in student debt should not be surprising, as he vowed to do so shortly after the Supreme Court rejected his initial student loan forgiveness plan in June 2023, as reported by the Journal.

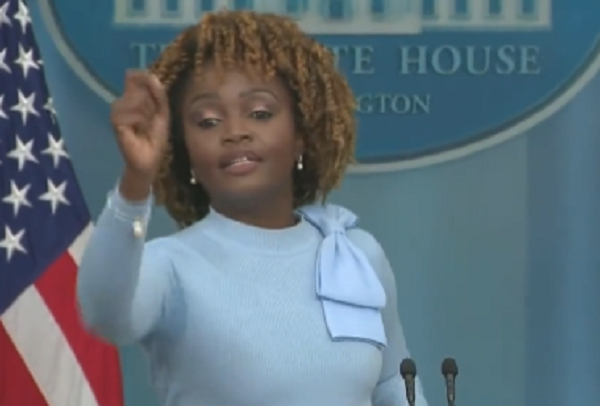

The Biden administration aims to start canceling significant amounts of student debt before the November election, seeking a political advantage for the struggling incumbent. A White House spokesperson declined to comment for the Journal’s article, and understandably so. What could he possibly say to make this situation look any better?

Regrettably for President Biden, there exist substantial barriers hindering his ability to cancel student debt in exchange for votes. One major obstacle is the lengthy process he has opted for following the Supreme Court’s criticism, which is considerably more time-consuming.

“The Higher Education Act requires that the Education Department conduct a so-called negotiated rule-making to develop the regulations, an unusual and slow process that isn’t required for most other regulations,” the Journal reported.

“Some in the administration feared the rules would get caught up in the government’s bureaucracy for months, making it unlikely that borrowers would see any relief before the election,” it added.

The administration has already conducted public meetings with stakeholders; however, there is still one necessary step in the process. Subsequently, the proposed new regulation must be submitted for public comments (not that the administration is likely to care about the content of those comments).

Following that, though, it is highly probable that the regulation will face legal challenges, most likely from Republicans who perceive it as a manipulative ploy to secure votes, and potentially from taxpayers who object to their funds being utilized to rectify avoidable errors made by others (or their representatives). The duration of these lawsuits navigating through the court systems is impossible to predict. However, considering that the election is merely seven months away and the public comment period for this new “negotiated rule-making” has not even commenced, it appears quite likely that no actual debt relief will be granted to Biden’s intended target audience of voters this year.

Consequently, what the Biden administration intends as an effort to regain the support of young voters may very well turn out to be yet another illustration of this 81-year-old president’s incapacity to achieve his objectives, even on the second attempt.