The U.S. discount retail chain Big Lots has declared bankruptcy as of Monday, amid ongoing inflationary pressures during the Biden-Harris administration that have adversely affected consumer spending and led to the closure of several retailers.

The company sought Chapter 11 protection after experiencing consecutive quarterly losses since 2022 and subsequently shutting down numerous locations. As of May, Big Lots operated approximately 1,300 stores in the United States, a decrease from 1,425 in early 2023, as reported by The Wall Street Journal. Additionally, Big Lots has announced that it has secured over $700 million in funding to navigate the bankruptcy proceedings and the subsequent sales process, with an affiliate of private equity firm Nexus Capital Management anticipated to take over the company.

“The actions we are taking today will enable us to move forward with new owners who believe in our business and provide financial stability,” Chief Executive Bruce Thorn said in a Monday press release.

The Chapter 11 filing occurs amidst a surge of bankruptcies within the retail sector, with 21 retailers having declared bankruptcy by July 16, marking a record for this timeframe since the onset of the pandemic in 2020, as reported by the Wall Street Journal. Additionally, the Bureau of Labor Statistics indicates that the retail industry experienced a loss of 11,100 jobs in August. These bankruptcies and job reductions are taking place as inflation compels consumers to adopt a more selective approach to their spending.

“Like many other retail businesses, the Company [Big Lots] has been adversely affected by recent macroeconomic factors such as high inflation and interest rates that are beyond its control,” the company wrote in its press release. “The prevailing economic trends have been particularly challenging to Big Lots, as its core customers curbed their discretionary spending on the home and seasonal product categories that represent a significant portion of the Company’s revenue.”

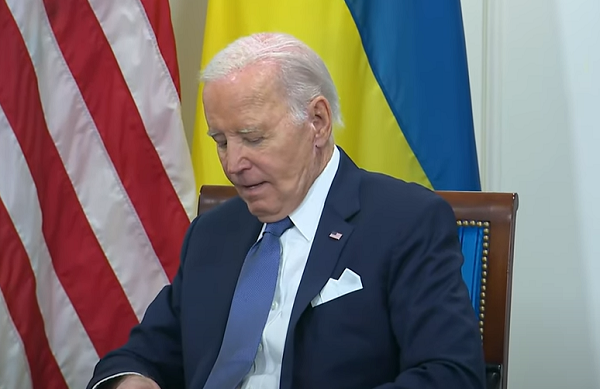

Since President Joe Biden assumed office in January 2021, prices have surged by over 20%, reaching a peak of 9% in June 2022, a significant increase from the 1.4% recorded at the conclusion of Former President Donald Trump’s administration.

In 2022, consumer sentiment experienced a sharp decline due to escalating inflation, and it has since remained within a limited range that has persisted over the last two years, as noted by Dana M. Peterson, Chief Economist at The Conference Board. In August, only 20.8% of consumers reported that business conditions were “good,” according to the Consumer Confidence Survey (CCS).

Additionally, consumers have become increasingly concerned about the labor market, as job growth fell short of economists’ expectations in both July and August. The CCS indicated that merely 32.8% of consumers viewed jobs as plentiful in August, a slight decrease from 33.4% in July. Furthermore, optimism regarding the stock market has diminished following a global market downturn in August, with only 46.9% of respondents anticipating an increase in stock prices over the coming year, down from 50.6% in July.

The economic challenges have also led to a rise in restaurant closures and bankruptcies. Notably, Red Lobster, the largest seafood chain globally, filed for Chapter 11 bankruptcy in May, while Hooters closed approximately 40 locations in June.