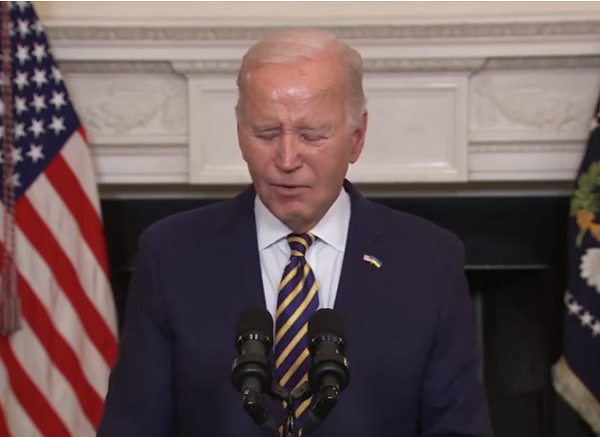

Following a record-breaking surge in one of the stock markets, President Joe Biden, a Democrat, took advantage of this positive development and proudly highlighted the apparent success of his economic policies, known as “Bidenomics,” on social media.

However, within a few days, those unprecedented gains and more were completely wiped out as all major stock markets experienced a sudden and significant decline. According to Yahoo! Finance, this market downturn occurred immediately after the release of an underwhelming economic and inflation report for the month of January.

This unexpected reversal of fortune seemed to partially support former President Donald Trump’s earlier prediction. Trump had cautioned that Biden’s economy, plagued by inflation, was vulnerable and on the verge of a forthcoming “crash.”

On Saturday, President Biden’s social media team shared a report from NBC News, published on Friday, which highlighted the S&P 500’s achievement of closing above the 5,000 mark for the first time in its history after five consecutive weeks of gains.

Biden posted to X saying:

Good news for folks as we start the weekend. The stock market going strong is a sign of confidence in America’s economy. https://t.co/3nnSiVWOYP

— President Biden (@POTUS) February 10, 2024

However, Yahoo! Finance reported on Tuesday that the three major stock market indices experienced a decline of over 1% each. The tech-centric NASDAQ saw a loss of 1.8%, while the Dow Jones Industrial Average lost 1.4%, equivalent to around 500 points.

Similarly, the S&P 500 also suffered a decline and dropped below the significant 5,000 mark. These stock market losses, in contrast to Biden’s previous statements, could potentially indicate a decrease in confidence in the American economy. These declines followed the release of the January economic report.

The report revealed that inflation, which the Biden administration has downplayed or claimed to have under control, had actually increased more than analysts had anticipated. According to The Hill, the Consumer Price Index, released on Tuesday, showed a 0.3% rise in price inflation from December to January. This exceeded the 0.2% prediction made by analysts and represented a 3.1% increase from the same period last year, surpassing the predicted 2.9% rise.

As a result, concerns arose that the Federal Reserve would likely postpone its plans to reduce interest rates. Over the past two years, interest rates have been raised significantly in an unsuccessful attempt to bring inflation back to its normal average of 2% year-over-year.

“Today’s CPI report caught a lot of people off guard — many investors were expecting the Fed to begin cutting rates and were spending a lot of time arguing that the Fed was taking too long to get started,” investment adviser Chris Zaccarelli told the outlet.

“This is only one month’s report and if next month’s report shows a decline in inflation then this will have been just a bump in the road, but if we see a new pattern of inflation stalling out at current levels (or worse increasing from here) then the stock market has further to fall.”

Approximately a month ago, CNN released a report stating that President Trump had made a controversial statement during an interview, where he predicted that Biden’s economy, which he described as “fragile,” would eventually “crash.”

Trump confidently stated that the current state of the economy was solely reliant on the success of his previous prosperous economic strategies. Furthermore, he expressed his concern by cautioning that the economy was highly susceptible to an imminent crash in the coming days.

“When there’s a crash, I hope it’s going to be during this next 12 months because I don’t want to be Herbert Hoover,” Trump said, referencing the former president in 1929 who presided over the massive stock market crash that precipitated the Great Depression that lasted for roughly a decade.

“The one president — I just don’t want to be Herbert Hoover.”

The recent decline in the market has raised questions about the potential impact on the Federal Reserve’s planned rate cuts. According to The Hill, President Trump, along with others, has accused Federal Reserve Chair Jerome Powell of being politically motivated and biased in his decision to cut interest rates.

Critics argue that this move would only serve to temporarily boost the economy, benefiting President Biden in an election year. This theory is supported by the fact that numerous polls consistently show that voters prefer Trump over Biden when it comes to economic policies.

This preference is likely influenced by the prosperity and wealth gains experienced during the Trump administration, in contrast to the high inflation, high interest rates, and economic challenges that occurred under Biden’s policies.