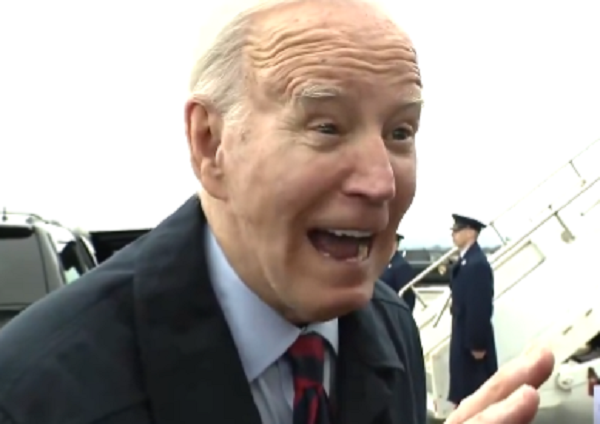

President Joe Biden, a Democrat, is once again challenging the United States Supreme Court by proposing another taxpayer-funded initiative for college-educated voters. According to Fox Business, as the crucial November elections approach, Biden is planning to request an additional $750 billion from American taxpayers to eliminate student debts. This move comes after a previous loan forgiveness plan was rejected by the Supreme Court. The recent proposal was introduced last week as an effort to push forward a student debt cancellation plan.

The Department of Education (DOE) stated that this initiative could benefit up to 30 million borrowers and estimated a cost of $150 billion. However, a more realistic evaluation by the Committee for a Responsible Federal Budget suggests that the actual cost could be significantly higher, possibly triple the initial estimate. The DOE’s official estimate does not consider scenarios where the Secretary of Education would cancel debts due to defaults or hardships.

“Including this provision, we estimate the plan could cost $250 billion to $750 billion, depending on how the additional cancellation is designed,” the CRFB found.

According to a study conducted by the Wharton School of the University of Pennsylvania, projections suggest that the expenses could potentially reach up to $559 billion. The loan forgiveness program entails various intricacies that contribute to its significant financial burden. One particular aspect of concern involves the forgiveness of debts for individuals facing vaguely-defined “hardships.”

“It is unclear how the Administration will define hardship, but they discuss 16 possible criteria such as other consumer debt, age, and health care or housing expenses and also declare hardship could be defined based on ‘any other indicators of hardship identified by the Secretary,”’ the report said.

Loan forgiveness is also extended to individuals who are at risk of defaulting.

“In assessing default risk, the rule allows for cancellation for those with an 80 percent likelihood of default, as determined by the Secretary,” the CRFB also found.

It is worth noting that currently, there is a significant amount of debt in default, totaling over $150 billion. Typically, loans in default have a recovery rate of around 70 percent.

According to NBC News, there is another provision being considered that would provide full cancellation of undergraduate loans for individuals who have been making payments for more than 20 years, and for graduate education loans, the period would be 25 years. Interestingly, even those who did not apply for forgiveness would still be eligible to receive it.

Furthermore, individuals who made poor choices in selecting their majors would also be granted loan forgiveness under this new plan. Additionally, borrowers who attended schools or programs that have low financial returns would also qualify for this government assistance.

This latest proposal is a continuation of President Biden’s unwavering determination to make student loan forgiveness a reality, despite the Supreme Court’s decision. During his remarks on June 30, President Biden made a firm commitment to do whatever it takes to achieve student loan forgiveness.

“I believe that the Court’s decision to strike down our student debt relief plan is wrong,” Biden said.

“But I will stop at nothing to find other ways to deliver relief to hard-working middle-class families.

“My Administration will continue to work to bring the promise of higher education to every American.”

Joe Biden is trying to unabashedly eclipse the Constitution with his attempt to “cancel” student loan debt.

The rule of law means something in this country, @POTUS.

See you in court.

— Attorney General Andrew Bailey (@AGAndrewBailey) April 8, 2024

This is nothing more than a blatant attempt to buy votes ahead of the 2024 election…